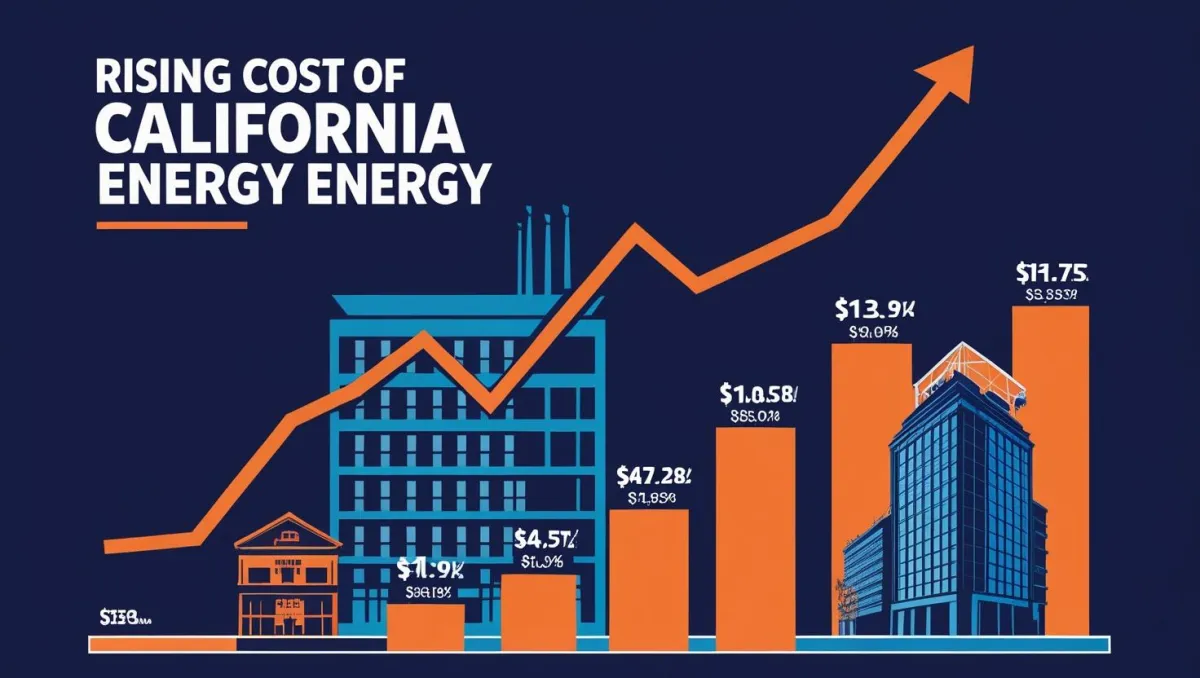

WARNING: Energy Rates Are Going Up And Solar Incestives Are Going Away

Read Our Blog Posts Below

⚡ Why Your PG&E Bills Keep Climbing—and Who’s Really Profiting

⚡ Why Your PG&E Bill Keeps Going Up — And Who's Really Benefiting

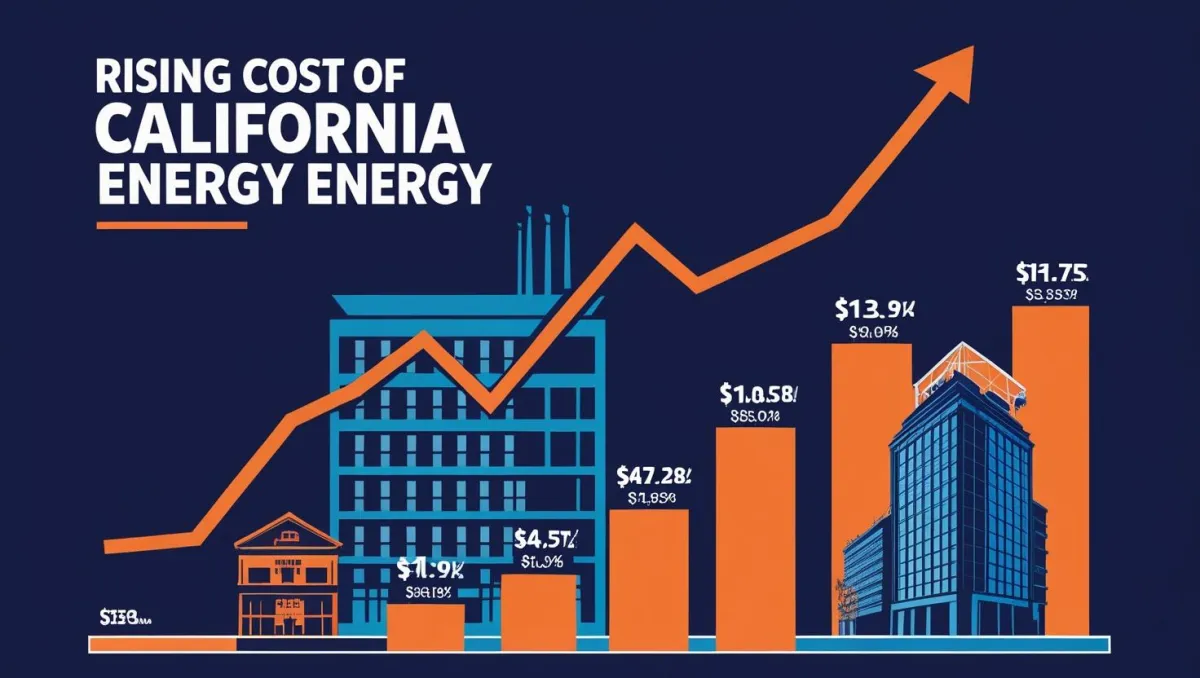

If you're a California homeowner, you've probably noticed your PG&E bill creeping higher month after month. While the utility blames inflation, wildfire risks, and infrastructure upgrades, the real picture is more complicated — and more frustrating.

Here’s what’s really driving the rising cost of electricity for PG&E customers.

📈 PG&E Wants to Boost Shareholder Returns

PG&E is pushing to increase its return on equity (ROE) — the profit they’re allowed to make for their investors — from about 10.3% to 11.3%. That may not sound like much, but it could add about $5.50/month to the average household bill starting in January 2026.

This request comes at a time when the utility is already seeing record profits, raising questions about who these rate increases are really for.

🔺 2024 Brought Multiple Rate Hikes

PG&E increased customer rates six times in 2024 alone, including a 13% base rate hike that added an estimated $440 per year to the average household bill.

For many families, total annual gas and electric costs have now passed $3,500 — making PG&E one of the most expensive utilities in the country.

💰 Record Profits for PG&E

Despite the rising costs for customers, PG&E posted a record $2.47 billion in profit in 2024, following another record-breaking year in 2023. Meanwhile, they’re asking regulators to approve an additional $4.4 billion in cost recovery for upcoming infrastructure projects between 2025 and 2026.

In short: you pay more, they profit more.

🧯 PG&E’s Justifications

To be fair, PG&E is also dealing with:

Ongoing wildfire liabilities

Massive infrastructure modernization projects

Costly undergrounding of power lines

Economic pressures from inflation and supply chain issues

The company says it's investing in safety and sustainability — and it has claimed to save $2.5 billion in operational efficiencies over the last few years.

Still, the bottom line remains: profits are climbing, and so are your bills.

🧾 What It Means for Homeowners

If PG&E's requests are approved:

Your bill could increase again in early 2026 by about $5–6/month

Costs for wildfire mitigation and infrastructure will continue to be passed on to you

Shareholders stand to gain even more, while affordability remains a growing concern

🧠 Final Thoughts

PG&E says it's working hard to deliver safe, reliable, and clean energy — and no doubt some of the investments are necessary. But it’s hard to ignore the fact that customers are shouldering more of the cost, while Wall Street investors are seeing record returns.

As utility rates climb and profits soar, homeowners are left wondering: who is PG&E really serving — the public, or the shareholders?

Want to lower your energy costs? Now may be the time to explore solar, battery storage, and energy-efficient upgrades — before the next rate hike lands in your inbox.

See If You Qualify for $0 Down

Find Out If Your Home Qualifies Before Rates Rise and Incentives Disappear

Save On Your Energy Bill

(Even If You’re Not Sure If You Will Qualify)

Stay Informed: Explore Our Latest Posts on Energy Costs and Solar News

⚡ Why Your PG&E Bills Keep Climbing—and Who’s Really Profiting

⚡ Why Your PG&E Bill Keeps Going Up — And Who's Really Benefiting

If you're a California homeowner, you've probably noticed your PG&E bill creeping higher month after month. While the utility blames inflation, wildfire risks, and infrastructure upgrades, the real picture is more complicated — and more frustrating.

Here’s what’s really driving the rising cost of electricity for PG&E customers.

📈 PG&E Wants to Boost Shareholder Returns

PG&E is pushing to increase its return on equity (ROE) — the profit they’re allowed to make for their investors — from about 10.3% to 11.3%. That may not sound like much, but it could add about $5.50/month to the average household bill starting in January 2026.

This request comes at a time when the utility is already seeing record profits, raising questions about who these rate increases are really for.

🔺 2024 Brought Multiple Rate Hikes

PG&E increased customer rates six times in 2024 alone, including a 13% base rate hike that added an estimated $440 per year to the average household bill.

For many families, total annual gas and electric costs have now passed $3,500 — making PG&E one of the most expensive utilities in the country.

💰 Record Profits for PG&E

Despite the rising costs for customers, PG&E posted a record $2.47 billion in profit in 2024, following another record-breaking year in 2023. Meanwhile, they’re asking regulators to approve an additional $4.4 billion in cost recovery for upcoming infrastructure projects between 2025 and 2026.

In short: you pay more, they profit more.

🧯 PG&E’s Justifications

To be fair, PG&E is also dealing with:

Ongoing wildfire liabilities

Massive infrastructure modernization projects

Costly undergrounding of power lines

Economic pressures from inflation and supply chain issues

The company says it's investing in safety and sustainability — and it has claimed to save $2.5 billion in operational efficiencies over the last few years.

Still, the bottom line remains: profits are climbing, and so are your bills.

🧾 What It Means for Homeowners

If PG&E's requests are approved:

Your bill could increase again in early 2026 by about $5–6/month

Costs for wildfire mitigation and infrastructure will continue to be passed on to you

Shareholders stand to gain even more, while affordability remains a growing concern

🧠 Final Thoughts

PG&E says it's working hard to deliver safe, reliable, and clean energy — and no doubt some of the investments are necessary. But it’s hard to ignore the fact that customers are shouldering more of the cost, while Wall Street investors are seeing record returns.

As utility rates climb and profits soar, homeowners are left wondering: who is PG&E really serving — the public, or the shareholders?

Want to lower your energy costs? Now may be the time to explore solar, battery storage, and energy-efficient upgrades — before the next rate hike lands in your inbox.

Don't Just Take It From Us

See What Our Clients Have To Say

We Work Exclusively With the Highest-Rated Installers and Lenders in the Industry